Personal Loans Ontario: Tailored Solutions for Your Economic Journey

Personal Loans Ontario: Tailored Solutions for Your Economic Journey

Blog Article

Navigate Your Financial Trip With Reliable Finance Solutions Designed for Your Success

In the large landscape of economic management, the path to accomplishing your objectives can often seem difficult and complex. With the appropriate advice and support, browsing your economic journey can come to be a much more manageable and effective endeavor. Reliable financing services tailored to satisfy your certain demands can play an essential function in this process, supplying a structured approach to safeguarding the needed funds for your aspirations. By recognizing the complexities of various lending alternatives, making notified choices during the application procedure, and properly taking care of settlements, people can leverage loans as calculated tools for reaching their economic landmarks. Yet exactly how specifically can these services be enhanced to guarantee lasting economic success?

Comprehending Your Financial Requirements

Understanding your monetary requirements is important for making informed decisions and attaining economic security. By taking the time to examine your financial situation, you can recognize your lasting and temporary goals, develop a spending plan, and create a strategy to reach economic success.

Moreover, understanding your financial requirements entails identifying the distinction in between essential expenditures and discretionary spending. Prioritizing your demands over desires can help you manage your funds better and stay clear of unnecessary debt. Furthermore, take into consideration elements such as reserve, retired life planning, insurance coverage, and future financial objectives when reviewing your financial requirements.

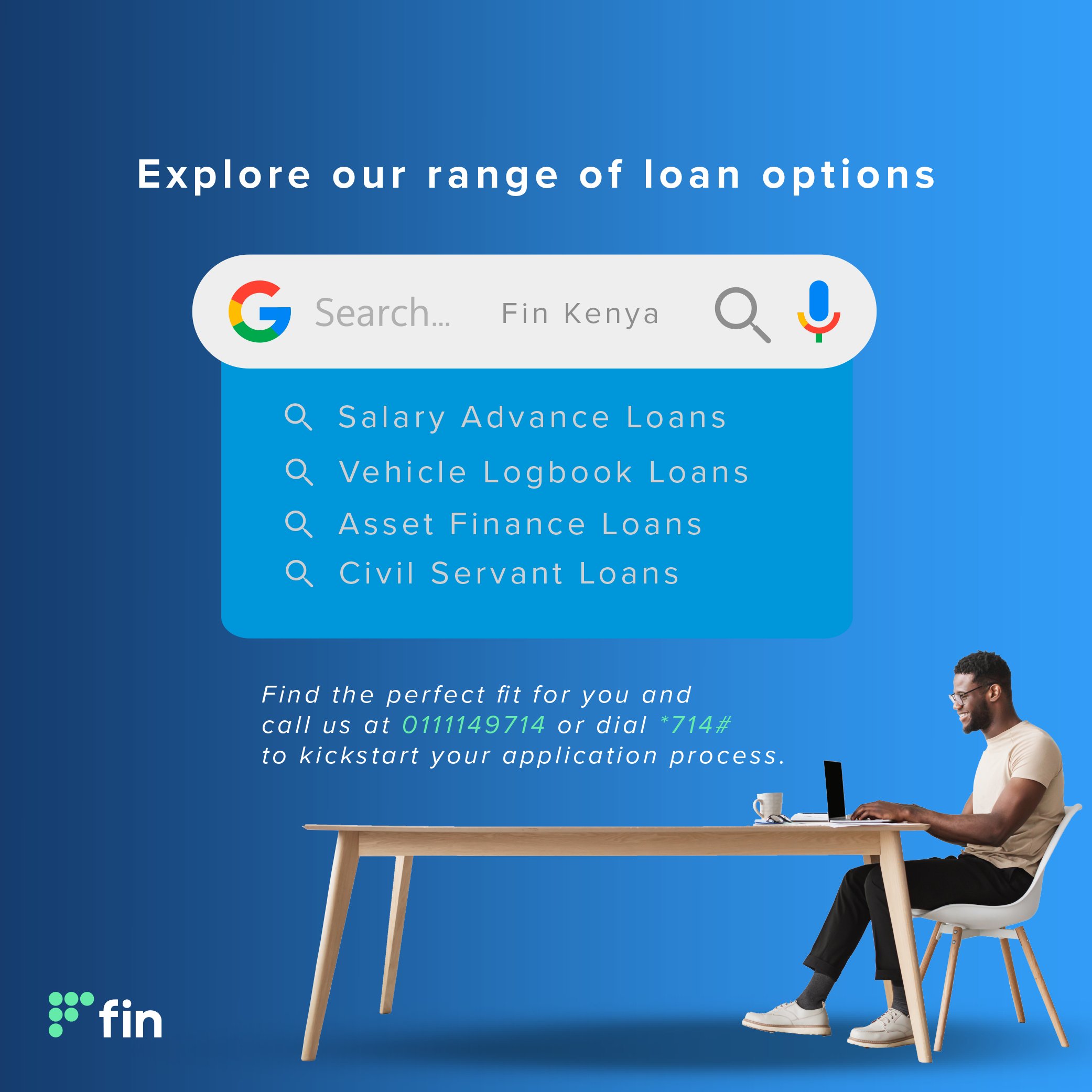

Checking Out Car Loan Options

When considering your monetary requirements, it is vital to discover various lending alternatives offered to identify the most appropriate solution for your certain scenarios. Recognizing the various kinds of car loans can aid you make educated choices that line up with your economic objectives.

One typical type is a personal funding, which is unsafe and can be made use of for numerous purposes such as debt combination, home renovations, or unexpected expenses. Individual car loans normally have repaired interest prices and month-to-month payments, making it less complicated to budget plan.

Another alternative is a secured financing, where you supply collateral such as a vehicle or residential property. Guaranteed loans commonly feature lower interest rates due to the decreased danger for the lender.

For those looking to purchase a home, a home loan is a prominent choice. Mortgages can differ in terms, rate of interest, and deposit demands, so it's important to check out different loan providers to discover the most effective suitable for your situation.

Requesting the Right Car Loan

Browsing the procedure of using for a loan necessitates a complete assessment of your economic requirements and persistent study into the readily available alternatives. Begin by reviewing the objective of the car loan-- whether it is for a significant purchase, debt consolidation, emergencies, or other demands.

As soon as you have actually recognized your economic demands, it's time to explore the finance products provided by numerous loan providers. Contrast rate of interest, repayment terms, fees, and eligibility standards to locate the finance that best fits your demands. In addition, consider variables such as the lending institution's credibility, customer support quality, and online tools for handling your financing.

When applying for a loan, guarantee that you give accurate and total information to expedite the authorization process. Be prepared to send paperwork such as evidence of income, recognition, and financial declarations as needed. By carefully choosing the best funding and finishing the application faithfully, you can set yourself up for economic success.

Taking Care Of Loan Settlements

Reliable administration of loan payments is vital for preserving financial stability and conference your responsibilities sensibly. To efficiently manage lending repayments, beginning by developing a comprehensive budget plan that outlines your revenue and costs. By plainly identifying exactly how much you can allocate towards lending payments every month, you can make certain timely repayments and stay clear of any type of financial strain. Establishing automated repayments or suggestions can likewise assist you stay on track and stop missed or late settlements.

Many economic organizations use choices such as financing deferment, restructuring, or forbearance to aid borrowers facing financial difficulties. By actively handling your finance payments, you can preserve economic health and wellness and job towards accomplishing your long-term monetary goals.

Leveraging Fundings for Financial Success

Leveraging car loans tactically can be a powerful device in accomplishing economic success and reaching your long-lasting goals. When visit this website used wisely, financings can supply the essential resources to spend in possibilities that might generate high returns, such as beginning a service, pursuing higher education and learning, or purchasing property. easy loans ontario. By leveraging lendings, individuals can accelerate their wealth-building process, as long as they have a clear plan for payment and a complete understanding of the dangers entailed

One trick element of leveraging car loans for financial success is to carefully analyze the conditions of the lending. Comprehending the rates of interest, repayment timetable, and any kind of connected charges is essential to ensure that the car loan aligns with your financial objectives. Furthermore, it's important to obtain only what you need and can sensibly manage to pay off to prevent falling under a financial debt trap.

Verdict

By recognizing the ins and outs of different lending options, making informed choices during the application process, and properly managing payments, individuals can utilize financings as tactical tools for reaching their financial landmarks. loan ontario. By actively handling your lending settlements, you can preserve financial health and wellness important source and work in the direction of achieving your long-term financial objectives

One secret facet of leveraging loans for monetary success is to carefully assess the terms and problems of the finance.In verdict, recognizing your financial demands, exploring financing options, using for the appropriate finance, taking care of loan repayments, and leveraging car loans for economic success are important steps in browsing your monetary journey. It is crucial to thoroughly take into consideration all aspects of lendings and economic choices to make sure long-term monetary security and success.

Report this page